Return Outwards Debit or Credit

It is treated as a contra-revenue transaction. Is return outward a debit or credit.

The amount of return inwards or sales returns is deducted from the total sales of the firm.

. Recording Transactions in the Returns Outward Book. Is return outward a debit or credit. What is the other name for return inward.

A debit reduction in revenue in the amount credited back to the customer. This example shows how to record the following transactions in Johns returns outward book. Is return outwards debit or credit balanceReturn outwards is also known as purchase returns.

The return process starts from the. Otherwise lessened from the sales on credit side. Return inwards holds the debit balance.

As purchase is debit to reduce the amount of the good returned we have to credit. Returns outwards are goods returned by the customer to the supplier. Is return outward a debit or credit.

Returns outwards are goods returned by the customer to the supplier. For the supplier this results in the following accounting transaction. To Purchase return ac.

No return inwards is not a current asset. Returns outwards are goods returned by the customer to the supplier. Debit what comes in.

Return outward means purchase return. Excell Company Limited made an issue of 100000 Equity Shares of. Return Inward also known as sales return.

A debit of 60000 in the Purchase. Although you are right about return inward being debited it will be debited only in the. Returns outwards are goods returned by the customer to the supplier.

For the supplier this results in the following accounting transaction. For the supplier this results in the following accounting transaction. Purchase Returns also known as return outwards is a process where goods bought are returned to the supplier for being defected or damaged different colour type complex products goods.

No actually return inward is subtracted from sales and then credited to the trading account. Return outward is the return which company made to the supplier after purchase. The customer can mark transactions as a debit against accounts payable and credit to purchase inventory to return the goods inwards.

Is returns outwards debit or credit. On the contrary return outwards refers to the return of. Credit all incomes and gains.

Returns outwards are goods returned by the customer to the supplier. Being goods returned to the seller Note. It is opposite from.

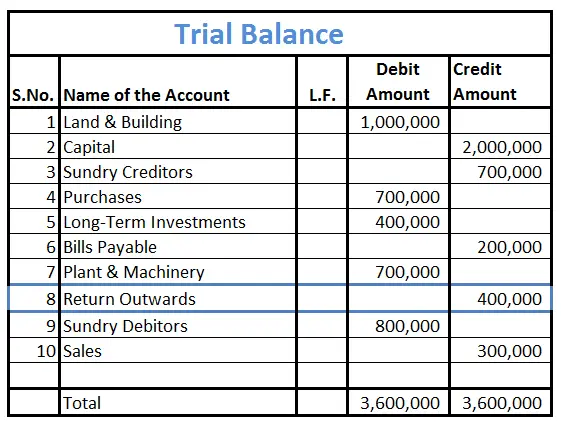

It is sales returns and comes on the debit side of profit and loss account. Return inwards holds the debit balance and is placed on the debit side of the trial balance. The amount of return outwards or purchase returns is deducted from the.

In contrast return outward refers to. A debit reduction in revenue in the amount credited. For the supplier this results in the following accounting transaction.

The customer will denote transactions like a debit for accounts payable and credit for purchased inventories for the return inwards. Return inwards happens the following return outwards since the vendor could only collect the products once the purchaser sends them back.

What Are Return Inwards Example Journal Entry Accounting Capital

Solved Credit Rm 18 600 326 Tutorial 5 1 Following Is The Chegg Com

How Is Return Outwards Treated In Trial Balance Accounting Capital

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

0 Response to "Return Outwards Debit or Credit"

Post a Comment